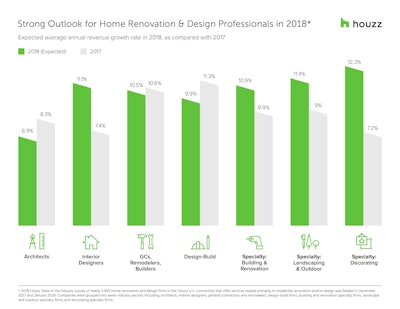

Graphic: Houzz

Graphic: HouzzHouzz has released its 2018 state of the industry report today, which surveyed nearly 3,400 professionals on their outlook of this year and a review of 2017’s performance.

The study was conducted from Nov. 28, 2017, to Jan. 31, 2018, and talked to various companies in the residential renovation and/or design business, including 278 landscape/outdoor specialty firms.

Of the architects, interior designers, general contractors, renovators and landscapers polled, over two-thirds are optimistic that this will be a good year. Landscapers, in particular, are confident in 2018 being promising with 41 percent saying it would be a good year, and 44 percent saying it would be very good.

Landscapers are also bullish about revenue growth in 2018 with their prediction 2.4 percentage points higher than 2017’s actual growth rate of 9 percent. These members of the green industry are also expected increases in revenue and profits for the year.

Sixty-eight percent of landscapers reported they expect demand for services to improve, and 37 percent believe the local economy will improve as well. The respondents were more split on the national economy getting better with 25 percent predicting improvement and 19 percent see it worsening.

Yet despite the positive outlook, tight labor markets and high material costs are major concerns for those in the landscaping field. Forty-eight percent of respondents said they expected labor availability to worsen and 50 percent said they expected labor costs to worsen.

As for the cost of material, one in two companies in each industry group expects the cost of materials to rise, but they feel the availability will mainly stay the same.

“With market fundamentals aligned in favor of the home improvement industry, 2018 is set to be another great year,” said Nino Sitchinava, principal economist at Houzz. “That said, businesses are cautious about tightening local labor markets that may hamper growth in many regions, and apparent economic uncertainty on a national level.”

Houzz also polled professionals on how business was in 2017 and at least three in five companies, regardless of industry group, reported revenue increases while at least two in five experienced annual growth rates of 10 percent or more.

While profits increased marginally according to the landscaping firms, business costs rose as well. The main cost driver cited was employee wages or benefits at 62 percent. The other two top cost drivers were products or materials at 52 percent and business insurance trailing at 38 percent.

Despite employees being their most expensive business factor, 33 percent of landscapers increased their staff in 2017. The main challenges landscapers listed for 2017 was difficulty hiring/being understaffed (41 percent), managing consumer concerns about costs (28 percent) and increased cost of doing business (27 percent).

Meanwhile, the type of work residential landscapers focused on in 2017 was mainly existing homes (64 percent) with far less work on new custom homes (11 percent) and new homes for sale (7 percent).

Majority of the landscaping firms polled have an annual gross revenue less than $500,000 (62 percent) while only 5 percent are bringing in $3 million or more. Surprisingly, 24 percent have zero employees and 44 percent have only one to four employees. Another 33 percent say they employ more than five.

To see the full industry report, click here.