2020 Ford F-150

2020 Ford F-150Yesterday, we talked about the research you should conduct before purchasing the truck of your dreams. Today, we’ll look at examining the prices and moving forward with the purchase.

Finding the right path

Where things can get really confusing in this whole process is how rebate programs work. As McParland explains, there are often multiple “pathways” you can take based on how you pay for the vehicle and what kinds of discounts the dealer or manufacturer is offering. Each pathway can lead to different prices, so it’s important to look closely at what a dealer is offering.

Cash Buyers: “By cash buyer, dealers don’t mean pulling money out of the bank. They mean you’re simply not using manufacturer financing. Cash buyers will get a certain rebate tier, maybe a couple of grand off the truck.”

APR Special: “When you choose to finance at a low APR, you save over the life of the loan, but upfront you give up some rebates.”

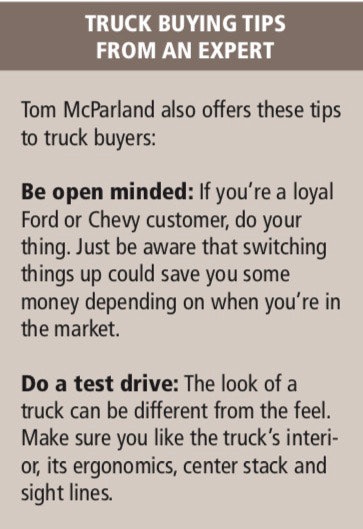

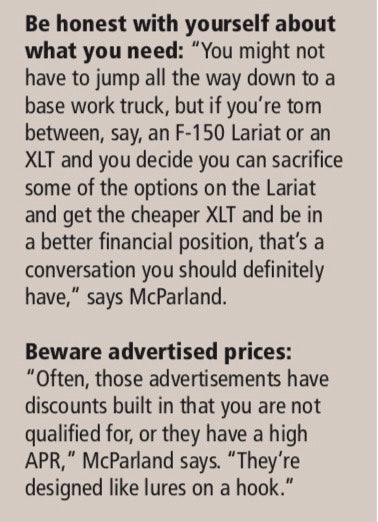

Advertised Rebates: “This is where dealer advertisements get – I wouldn’t call it sneaky – but you want to take a lot of these advertised prices with a grain of salt. On these, you’ll get the maximum amount in rebates, maybe $4,000 or $5,000 off the truck from the factory before any dealer discount. But the caveat here usually is that you have to take the manufacturer’s loan at a high interest rate, usually 6.25 to 6.5 percent. So when you look at the loan math over time, that interest completely neutralizes the rebates they gave you.”

With this in mind, it’s important to understand that the prices you solicited from multiple dealerships are hardly ever apples-to-apples.

“That’s why getting the itemized breakdown is crucial. The out-the-door price matters, but one of the other pieces is the gap between the MSRP and the dealer sale price prior to any rebates,” McParland explains. “Because the rebates are going to come from the factory no matter which pathway you take. So it just depends on what’s most advantageous for the customer based on their financing situation.”

McParland gives the following example to explain what this could look like:

Dealer A has a $54,000 truck that it is selling for $50,000 before rebates. That’s $4,000 out of its pocket right off the top. Dealer B, on the other hand, has a $54,000 truck selling for $52,000 before rebates.

“So even though Dealer B might be using a stronger rebate program, it’s not offering as aggressive a deal off the top,” McParland says.

After receiving your pricing breakdowns from the dealers you contacted, carefully review how each dealer is getting to a final price.

Those truck buyers interested in a Toyota or Nissan can have an easier time with all of these pathways, McParland says, as import automakers tend to be more straightforward with their rebate programs.

Buy your truck

Once you’ve landed on a truck deal you’re happy with, head into the dealership with all of your paperwork and buy your truck, McParland says.

If this sounds like a lot of work, that’s because it is. After all, McParland has built a career out of it. He says he and his staff earn most of their pay after the dealer prices start rolling in as they try to figure out what buying pathway is most advantageous for a particular customer.

EDITOR’S NOTE: Wayne Grayson is the online managing editor of Equipment World, another Randall-Reilly publication.