The chief economist for the Associated Builders and Contractors maintains his opinion that 2022 will be a year of growth, but 2023 could be very different.

“The economy will remain unbalanced for now with supplies struggling to keep up with demand,” say Ariban Basu.

From his perspective, there are many places to begin any economic discourse. There is the Russian assault on democratic Ukraine, creating supply challenges in several categories, and the re-emergence of Covid-19 in parts of Asia and Europe causing additional impacts. While many still anticipate commodity prices to decline later this year, the political conflicts and ongoing pandemic continue to have an impact. In the end, Basu says, all those things and more layer into one story, inflation.

“Ukraine, Russia and omicron in China and Europe hampers recovery. It will get worse before it gets, and that means, of course, the supply side is struggling, which means you still have inflationary pressures,” Basu says. “Along with rising wages, amid the 'great resignation,' this unbalanced economy translates into higher-than-average inflation in 2022.”

The Federal Reserve's forecast for inflation this year is 4.3%. Basu is predicting 5%.

“The inflation story is real,” he says. “Inflation is likely to be more persistent than many people are thinking. Inflation is larger and longer lasting than anticipated. Just the sheer nature of the economic recovery to this point has been inflationary.”

His forecast for the year goes beyond inflation and instead defines 2022 as being wrapped in stagflation, a combination of high unemployment and inflation. Basu foresees that scenario continuing throughout 2022 with very soft economic growth and maybe even a recession in 2023 coupled with unusually high inflation.

To date, economists have varied opinions on whether a recession is likely in the coming year or beyond. One of the factors holding back thoughts of recession is the financial markets are doing well and the overall economic outlook appears good. Basu believes there likely will be a modest or mild recession that would also result in a decline in the inflationary expectations.

“All of a sudden, those inflation expectations would come back down, because the economy is shrinking, and inflation is not going to be what it has been. With that, you will see inflation come down, the Federal Reserve will stop tightening, and then we can grow,” he says. Basu is estimating as many as six or seven interest rate increases in 2022 and as many as 11 quarter-point rate increases by the end of 2023.

“The period of softer economy I think would be relatively short lived in the rate of six months or so and then the economy would start bouncing back once again; that's my best guess,” Basu adds. “It would happen at some point next year, but I don't think it'd be a very severe recession.”

Part of his basis for concern related to his opinions on how the Federal Reserve has handled the money supply and interest rates in recent years. While stimulus funds at the start of the pandemic generated economic activity, they also led to inflation as the money supply increased.

“When you layer on all the global supply chain structures and the upheaval in the U.S. labor market, they should have started tightening interest rates much sooner than they did,” he says. “Because they waited so long, inflation expectations have been rising.” Increases in inflation expectations impact commodity prices and union wage negotiations.

“Now those inflation expectations have become untethered,” Basu says. “They must work very hard to bring this inflation out of the economy, and that means a lot of rate increases. Is the economy ready to handle that?

“That's why I've been saying 2023 could be a very different year for the U.S. economy. I don't have confidence in them to engineer that soft landing.”

Supply and demand

Depending upon the product, Basu anticipates the supply chain disruptions to continue into 2023 and possibly even into 2024.

Similarly, if the supply chain issues remain, price escalations will remain with them. For example, no one really anticipates a flood of computer chips to be available in 2022. Plans for new facilities have been announced by some manufacturers, but it takes years to build the plants and more time to work up to capacity.

“As the rest of the world wakes up from this economic slumber, demand for certain commodities is going to be rising,” Basu says. “If you've got supply chain issues and the global economy is reawakening, what does that translate into? Rising commodity prices.

“We have right now the supply chain issues that are keeping these commodity prices high, and I think that's going to persist for quite some time to come,. We economists like to say things like the cure for high prices is high prices, and prices right now for oil, natural gas, copper, steel, aluminum and other commodities are very high, which is an inducement for suppliers to produce more.”

With Russia being a major supplier of oil and natural gas, the decline in prices may not be seen due to lingering sanctions even when the war is over, he says.

“For many of these other commodities, like steel, I think these prices are going to fall significantly later this year,” Basu says.

Associated Builders and Contractors

Associated Builders and Contractors

Working from home ... in construction?

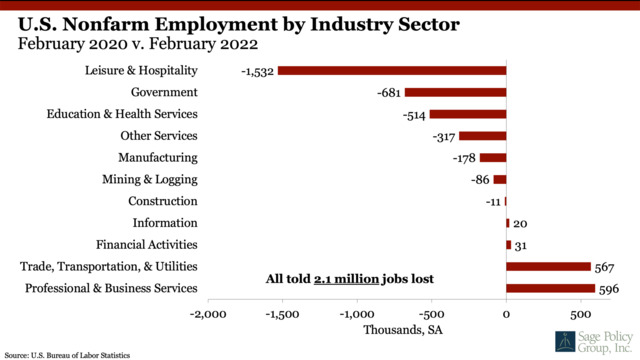

Comparing employment in February 2020 versus employment in February 2022 suggests that America lost 2.1 million jobs over that period. Using gross domestic product as a marker, Basu says in theory the U.S. has recovered. Then again, maybe not.

“By the second quarter of last year the gross domestic product was above the pre-pandemic level but we're doing more with fewer people,” Basu says. “Areas like leisure and hospitality have lost 1.5 million jobs, while over that same period professional and business services show growth because those areas offer remote job opportunities.”

The American workforce expects different things, not just higher wages but the option to work from home. A recent survey by GoodHire determined that 68% of Americans would choose remote work options over in-office or at the job site. Also, 74% of Americans believe that companies not offering remote working arrangements will lose major talent.

“The point is, it is very difficult for industries that require people at the job site (construction, manufacturing, retail, hospitality) because so many people in the job market are now looking for remote worker opportunities,” Basu says. “Construction simply cannot offer that in abundance for obvious reasons.”

More recently, labor force participation has been rising, and there are several reasons for that including vaccinations, falling infection rates, children being back in school and people chasing higher wages and inflation.

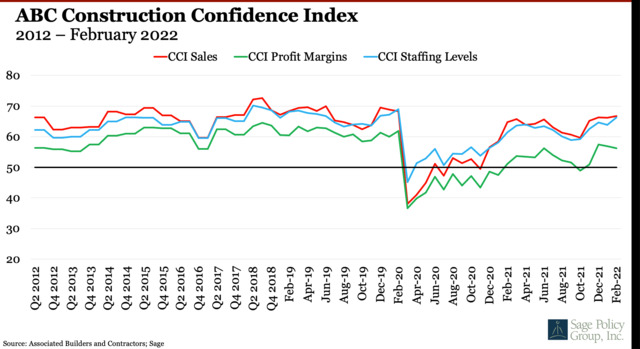

As for construction specifically, data by the U.S. Bureau of Labor Statistics indicated the construction industry added 19,000 jobs in March, marking the first time in 23 months the industry has exceeded pre-pandemic levels. Despite those numbers, there remains an ongoing need for more labor.

“It doesn't support as many jobs as it did pre-pandemic, and one of the reasons for that is that you have job openings often, but you can't fill them,” Basu says.

Today’s construction workers tend to be a bit older than the overall workforce because baby boomers played a larger part in the goods producing industries like construction and manufacturing. Now, the industry is left with younger generations to fill available job openings, and there are about 400,000 unfilled jobs in the industry.

The rapidly growing occupational category within the construction workforce is unskilled laborer. “While many refer to the current circumstances as a labor or worker shortage, it is perhaps more properly characterized as a skills shortage,” he says. “A lot of construction firms are taking on unskilled people hoping they'll stick around for three months or six months and be able to therefore be trained up to become more productive workers.”

Even when successful in finding employees, many contractors are facing much turnover due to the wage differences.

“If you want safe construction job sites, you want reliable people who know what they're doing all the time, who are of one mind with you when it comes to safety and productivity,” Basu says. “That's just challenging given the labor market right now. What you often end up doing is paying more so you can hold onto those workers who have those skills and have that commitment to the industry.”

However, for contractors, this has the potential to put even more downward pressure on margins. “It is likely that, as bid prices continue to soar, more project owners will choose to delay project starts,” Basu says.

Associated Builders and Contractors

Associated Builders and Contractors

Moving forward

Despite all these inflationary pressures, many construction firms remain busy, and projects have continued to move forward.

Within residential construction, home prices are rising due to a lack of inventory of unsold homes. Contractors cannot meet the demand due to the continued rise in lumber, copper, glass prices and workers’ wages.

“Many homebuilders find that they cannot supply their buyers at a price point comfortable for those would-be purchasers,” Basu says.

Also, with the ongoing trend of working from home, the market for new office buildings is limited. Similarly, as many storefronts were vacated during the pandemic, shopping centers also are not a current top priority. Basu says hotel occupancy has not yet met pre-pandemic levels, leaving hotel construction on a lower tier as well.

“The current situation also creates complications for public agencies considering when to start large-scale infrastructure projects,” he says.

Most contractors were supportive of the $1 trillion infrastructure bill approved by Congress. It includes spending to address major deficits relating to surface transportation and other forms of transportation. Despite the interest in getting the work, Basu does not believe the capacity is there to handle a flood of infrastructure projects within the industry.

“It is a challenging time to begin such projects, given the workforce shortages that remain and materials price inflation,” he says. Also, Basu notes that as with general workers, there has been a shortage of engineers since pre-pandemic days to deliver infrastructure construction services in an efficient manner that would allow taxpayers to see a meaningful rate of return.

“Undoubtedly, some public administrators will decide to extend planning time, delaying project start dates,” Basu says, noting that he is supportive of such a measure, even spreading the work out over several years.

“What's going to happen if you try to rush this is you're going to be delivering construction or receiving construction services at a time when prices are really high and capacities really constrained,” he says. “Unfortunately, because of that supply capacity constraint, it makes sense to spread these prices over a longer period and then maybe the taxpayer gets a better rate of return because the cost of construction services is not quite as high as it otherwise would be.”