Graphic: Pied Piper

Graphic: Pied PiperFor those considering going shopping for a UTV for the landscaping company, Pied Piper has crunched the numbers and has some interesting stats on what to expect from various dealerships.

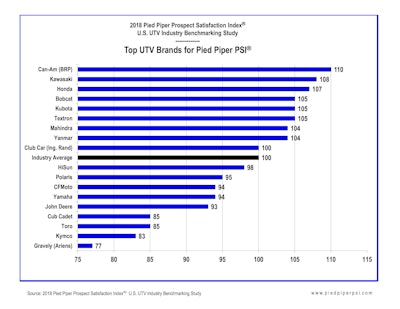

According to its Prospect Satisfaction Index (PSI) U.S. UTV Industry Benchmarking Study, BRP’s Can-Am dealerships was the top-ranked brand, while Kawasaki and Honda took second and third, respectively.

Bobcat, Kubota and Textron tied for fourth place.

The study was conducted from July 2017 to April 2018 and used 1,168 hired anonymous ‘mystery shoppers’ at dealerships across the U.S.

Mystery shoppers are commonly used in the automotive and motorcycle industries to improve the sales effectiveness of their dealer networks. The top-scoring brands are those considered “more helpful” and this is the first year Pied Piper has applied the PSI approach to researching the UTV market.

While UTVs previously were only associated with work or play, Pied Piper is saying those boundaries between the two are disappearing.

Yet there is a difference between going to a powersports dealership that sells equipment such as motorcycles and ATVs and an outdoor power equipment dealership that is selling your other commonly used equipment.

When shopping for a UTV at a powersports dealership, they are more likely to focus on customer needs, showcase the vehicle in a walk around and promote their dealership. The study also reports they are more likely to try to steer a customer away from their preferred brand.

Outdoor power equipment dealerships, on the other hand, provide test drives and printed materials but are less likely to get customer contact information to follow up.

A current issue with UTV dealerships is that some are professionally run with salespeople who go above and beyond, while others sell UTVs on the side and focus on their other products.

If you’re looking for a UTV walkaround, Honda, Kawasaki and Can-Am dealers are your best bet, as they showcased their models’ features on average more than 90 percent of the time. Meanwhile, Gravely, Toro and Bobcat dealers showcased their vehicles, on average, less than 70 percent of the time.

On average, dealers selling Yanmar, CFMoto and Kubota offered an immediate test drive more than 40 percent of the time. Polaris, Toro and Gravely dealers offered an immediate test drive less than 20 percent of the time.

Brands like Club Car, Kubota and Honda made a point to mention their high resale value as a reason to buy, while Toro and Polaris mentioned it less than 10 percent of the time.

Other dealers mentioned service convenience solutions, such as mobile “come-to-you” service or service pick-up and delivery as a reason to purchase. Club Car, Kubota and Yanmar mentioned these around 30 percent of the time while Gravely, Toro and Polaris mentioned it slightly less at 20 percent of the time.

Landscapers looking for a dealer that will go through the numbers will find it more likely at dealerships selling Bobcat, Mahindra and Honda, which did it 50 percent of the time, while Toro, Gravely, and Yamaha suggested going through the numbers or making a deal less than 30 percent of the time.

Photo: Jill Odom

Photo: Jill OdomThose looking for financing will find it mentioned 65 percent more often from dealers selling Can-Am, Kubota, Honda and Yanmar. Gravely, Yamaha and Toro are less likely to bring up financing 50 percent of the time.

If you’re wanting a brand that can follow up with you in the future, Bobcat, Kawasaki and Can-Am dealers do so more often, while Cub Cadet, Kymco, Club Car and Kubota ask for the customer’s information less than 35 percent of the time.

Dealers that were most likely to mention negatives associated with the brands they’re carrying included Toro, Kubota and Yamaha.

As you can tell, the UTV sales behavior is scattered across the board, and for some brands, even shopping online is difficult.

“It’s not always easy to be a UTV customer today,” said Fran O’Hagan, president and CEO of Pied Piper. “Because the UTV market is still young, strong dealerships with skilled salespeople are an important competitive advantage for UTV manufacturers.”